Whether you’re an expat sending money home to your family, a retiree receiving your pension, or a professional managing cross-border finances, moving money in and out of Thailand is a crucial task. The world of international money transfers in Bangkok can be confusing, with a vast difference in the fees, exchange rates, and transfer times between various services. Choosing the wrong one can cost you a significant amount of money.

Gone are the days when your only option was a slow, expensive bank wire. Today, a new generation of financial technology (fintech) companies competes with traditional banks, offering faster, cheaper, and more transparent services. To help you navigate your options and keep more of your hard-earned money, we’ve created the definitive guide. From the best modern apps to the most reliable traditional methods, this is how you send money internationally like a pro.

Why Trust This Guide?

As a Bangkok resident who has managed finances across multiple countries for years, I’ve personally used every service on this list. I’ve experienced the sting of a terrible exchange rate from a traditional bank transfer and the delight of a near-instant, low-fee transfer using a modern app. I’ve helped friends figure out the best way to receive their salaries from overseas and advised clients on the most efficient methods for transferring large sums. This guide is built on that direct, practical experience—the successes, the mistakes, and the hard-won knowledge.

Understanding the Key Factors: What to Look For

Before you choose a service, understand the three main costs:

- Transfer Fee: A flat or percentage-based fee for making the transaction.

- Exchange Rate Margin: This is the hidden fee. The service offers you an exchange rate that is worse than the real, mid-market rate, and they pocket the difference.

- Receiving Bank Fees: Sometimes, the recipient’s bank in Thailand will charge a fee to receive an international wire.

The Best International Money Transfer Options at a Glance

| Service Name | Best For | Key Feature | Transfer Speed |

|---|---|---|---|

| Wise (formerly TransferWise) | Most expats, low fees, transparency | Real mid-market exchange rate | Fast (minutes to 2 days) |

| Revolut | Multi-currency accounts, frequent travelers | Holding and exchanging multiple currencies | Fast |

| DeeMoney | Excellent value for sending money from Thailand | Great outbound rates & flat fees | Same-day |

| Traditional Bank SWIFT Transfer | Very large, official transactions | Security, direct bank-to-bank trail | Slow (3-5 business days) |

| Western Union | Sending or receiving physical cash | Global cash pickup network | Very Fast (minutes) |

The Modern Fintech Solutions: Fast, Cheap & Transparent

These online platforms have revolutionized money transfers and are the top choice for most expats.

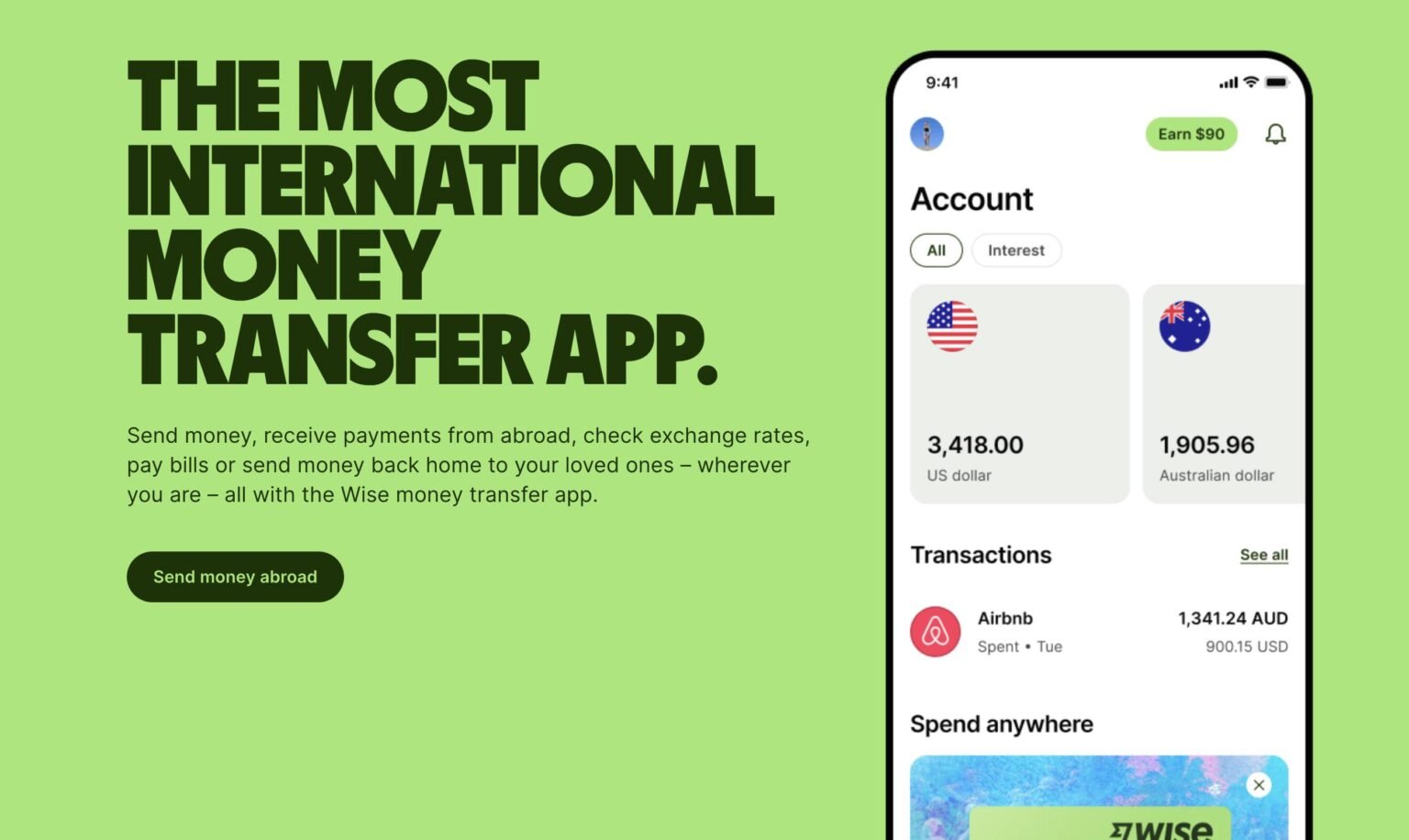

Wise: The Expat Gold Standard

Wise is, without a doubt, the most popular and trusted service for international money transfers among the expat community in Bangkok. I use it myself almost exclusively. Their key advantage is their transparency: they always use the real, mid-market exchange rate (the one you see on Google) and charge a small, clear fee upfront. There are no hidden markups. You can send money to a Thai bank account in minutes.

- Website: https://wise.com/

- Service Type: Online Money Transfer & Multi-currency Account

Master the Art of Food Delivery in Bangkok

Which app is better for street food? How do you find the best deals? Our pro guide compares Grab vs. LINE MAN and shares insider tips to help you eat better for less.

Revolut: The Multi-Currency Powerhouse

Revolut is another excellent fintech app that’s great for people who deal with multiple currencies. It allows you to hold and exchange dozens of currencies within the app at great rates. This is incredibly useful if you travel frequently or receive income in different currencies. You can then transfer the funds to a Thai bank account.

- Website: https://www.revolut.com/

- Service Type: Online Money Transfer & Multi-currency Account

DeeMoney: The Best for Sending Money from Thailand

While Wise is fantastic for sending money to Thailand, DeeMoney, a Thai-based fintech company, is often the best and cheapest option for sending money out of the country. I recommend this to all my friends who need to send funds back home. They offer a simple flat fee and excellent exchange rates for outbound transfers.

- Website: https://www.deemoney.com/

- Phone: 02 821 5555

- Service Type: Online Money Transfer (especially outbound from Thailand)

The Traditional Method: Bank SWIFT Transfers

This is the old-school way of sending money directly from your home bank account to a Thai bank account via the SWIFT network.

How it Works & When to Use It

You initiate a “wire transfer” from your bank’s international transfer section. This method is still the standard for very large, official transactions, such as transferring funds to purchase a property or to meet the financial requirements for a retirement visa. While slower and more expensive, it provides a clear, official paper trail between two major financial institutions. I’ve used this method for visa-related financial proof.

- Key Banks in Thailand: Bangkok Bank, Kasikornbank (KBank), SCB.

- Website (Bangkok Bank): https://www.bangkokbank.com/en/Personal/Other-Services/Transfers/Transferring-into-Thailand

- Service Type: Traditional Bank Wire (SWIFT)

The Cash Solution: For Emergencies

For times when you need to send or receive physical cash quickly.

Western Union: The Global Cash Network

Western Union is the undisputed global leader for cash transfers. Someone can send money from a Western Union agent in their home country, and you can pick it up as physical cash from an agent in Bangkok within minutes. It’s perfect for emergencies, but the fees and exchange rates are generally much worse than online services.

- Website: https://www.westernunion.com/th/en/

- Service Type: Cash Pickup & Delivery

Frequently Asked Questions

What is the cheapest way to transfer money to Thailand?

Can I use PayPal for international transfers to Thailand?

How can I avoid high bank fees?

What is the 'mid-market exchange rate'?

Are online money transfer services safe?

References

For more on finance, banking, and regulations in Thailand, we recommend these trusted external sources:

- Bank of Thailand: The central bank of Thailand and the main regulatory body for financial institutions in the country. Their website is the official source for financial regulations and data. https://www.bot.or.th/en/

- The World Bank in Thailand: Provides high-level economic data, reports, and analysis on Thailand’s economy and its connection to global financial systems. https://www.worldbank.org/en/country/thailand

- 25 Best Dim Sum in Bangkok: The Ultimate 2026 Guide - 10/02/2026

- 10 Best International Moving & Relocation Companies 2026 - 31/01/2026

- 20 Best Indian Restaurants in Bangkok (2026 Guide) - 26/01/2026

![A Guide to International Money Transfers in Bangkok (and Avoiding High Fees) [year]](https://bangkokdays.com/wp-content/smush-webp/2025/10/A-Guide-to-International-Money-Transfers-in-Bangkok-and-Avoiding-High-Fees-year-scaled.jpg.webp)